Silver 2021 Price Predictions and 5-Year Forecast

2021 白銀價格預測、走勢和5年預測

By Jeff Clark, Senior Analyst, HardAssetsAlliance.com

What will the silver price do in 2021? And where is it headed over the next 5 years?

2021年白銀價格將做什麼?未來5年的發展方向如何?

I’ve compiled silver price predictions from a number of precious metals analysts and consultancies. I also make my own prediction, based on the key factors that in my experience are most likely to influence the silver price both this year and the next five years.

我已經彙編了許多貴金屬分析師和諮詢公司的白銀價格預測。根據我的經驗,我也根據今年和未來五年最有可能影響白銀價格的關鍵因素做出自己的預測。

This will be fun, so let’s jump in!

這將會很有趣,我們開始吧!

Surveying the (Silver) Landscape

白銀市場調查報告

The table below shows the silver price prediction from various commodity and bank analysts for 2021. Here’s what they think we’ll see this year.

下表顯示了各種商品和銀行分析師對2021年白銀價格的預測。這就是他們認為我們今年會看到的價格。

Silver Price Predictions 2021

2021白銀價錢預測

Most industry analysts predict the silver price will move higher this year, though five project it will remain below $30.

大多數行業分析師預測,今年白銀價格將上漲,儘管有五個項目預測白銀價格將保持在30美元以下。

The average of all these analysts is in the low $32 range.

所有這些分析師的平均值都在32美元的低位範圍內。

But as you can see, that range is quite wide. And that is an important consideration when predicting where the price might go… silver can be very volatile at times, the result of its small market size and that it doesn’t take much cash entering or exiting to have a big impact on the price. As such, the swings—both up and down—can be bigger than what most other assets experience, including gold. This fact has to be taken into account when looking at how high or low the price might go.

但是正如您所看到的,該範圍非常廣泛。這是預測價格可能走向的一個重要考慮因素……白銀有時可能會非常波動,這是由於其市場規模小以及不需要花費大量現金進出對價格產生重大影響的結果。因此,波動(上下波動)可能大於包括黃金在內的大多數其他資產所經歷的波動。在查看價格可能高低時,必須考慮到這一事實。

What do I think the silver price will do this year, and over the next five years? To answer that question let’s look at the…

我認為今年和未來五年白銀價格將如何變化?為了回答這個問題,讓我們看一下...

Factors Most Likely to Influence Silver Prices

最有可能影響白銀價格的因素

While there are a number of variables that can impact the silver price, let’s look at those most likely to play out this year and beyond and determine if they’re likely to push the price higher or lower…

儘管有許多變量會影響白銀價格,但讓我們看一下今年和以後最有可能出現的那些變量,並確定它們是否有可能將價格推高或降低……

Industrial Demand

工業需求

Roughly half of all silver goes toward a variety of industrial applications (and another third to jewelry). Demand from industrial users usually doesn’t fluctuate all that much, but the next four years is likely to see a substantial increase due to President Biden’s“green” policies.

所有白銀中大約有一半用於各種工業應用(另一半用於珠寶業)。工業用戶的需求波動通常不會很大,但由於拜登總統的“綠色”政策,未來四年可能會出現大幅增長。

That’s because silver is a key component in many green technologies. Since it is most the most conductive of the metals, it is vital to making green technologies what they are. And given that a major focus for Biden is green energy, silver demand from the industrial sector is bound to grow.

那是因為銀是許多綠能技術的關鍵組成部分。由於它是金屬中最具導電性的,因此對製造綠能技術至關重要。鑑於拜登的主要重點是綠色能源,工業部門對白銀的需求必將增長。

If industrial demand grows as I expect, the silver price is likely to… (increase)

如果工業需求如我所願增長,白銀價格可能會…(上漲)

Investment Demand

投資需求

The factor that has the biggest impact on the silver price at any time is not industrial demand or jewelry demand. It is investment demand. Here’s the evidence…

任何時候對銀價影響最大的因素都不是工業需求或珠寶需求。是投資需求。這是證據……

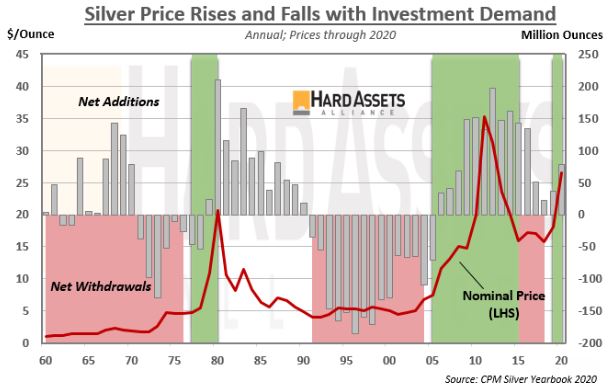

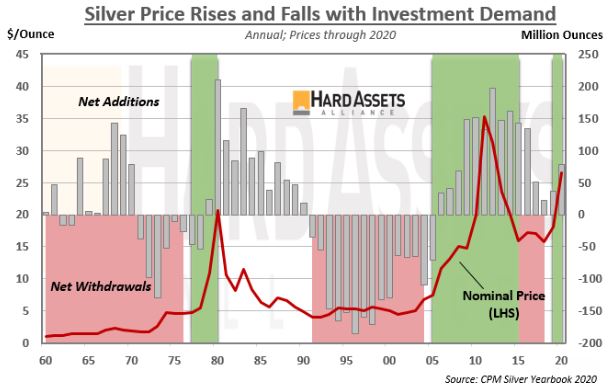

This chart, going back to 1960, demonstrates the link between investment demand and prices. The red shaded areas show that selling from investors led to lower or weak price, while the green shaded areas show that rising demand from investors led to rising prices.

該圖表可以追溯到1960年,展示了投資需求和價格之間的聯繫。紅色陰影區域表示投資者的賣出導致價格下跌或走軟,而綠色陰影區域表示投資者的需求上升導致價格上漲。

Silver Price Investment Demand

The key to this chart is that when investment demand shifts from net selling to net buying, the price has risen (and vice versa). As such…

白銀價格投資需求

該圖表的關鍵在於,當投資需求從淨賣出轉向淨買入時,價格已經上漲(反之亦然)。因此…

• As investment demand goes, so goes the silver price.

投資需求增大,銀價也會隨之上漲

So are investors buying or selling silver?

所以投資客目前是買還是賣呢?

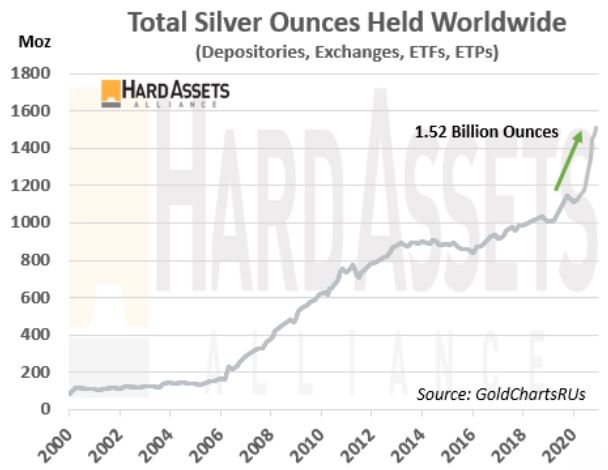

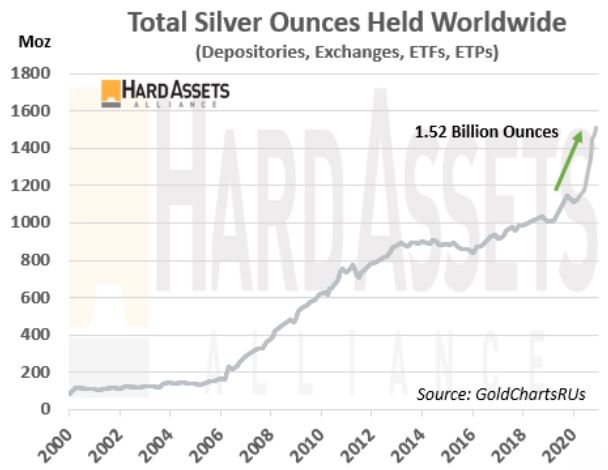

This chart from Nick Laird at GoldChartsRUs shows the total physical silver holdings by funds, exchanges, and storage facilities. Look what’s been happening…

GoldChartsRUs的尼克·萊爾德(Nick Laird)的這張圖表顯示了按資金,交易所和存儲設施的實際總白銀持有量。看看發生了什麼...

Total Silver Oz Held Worldwide

國際白銀現貨總額

Investment demand for physical metal has never been higher! Even when the vaccines came out investment demand continued to surge. Investors clearly want exposure to silver.

對實體金屬的投資需求從未如此高!即使疫苗問世,投資需求也繼續飆升。投資者顯然希望投資白銀。

The Silver Institute reported that they fully expect investment demand for bullion to continue to march higher in 2021.

Silver Institute報告稱,他們完全預計2021年對金條的投資需求將繼續增長。

I can also tell you that demand for silver bullion spiked at Hard Assets Alliance last year, particularly when scares about the virus exploded, along with the stock market crash in March. Volumes went through the roof. They’ve spiked again in January.

我還可以告訴你,去年硬資產聯盟對白銀的需求激增,特別是當對這種病毒的擔憂激增以及3月份股市崩盤時。大量的東西穿過屋頂。他們在一月份再次飆升。

As such, if investment demand—the biggest impact on the price— continues to rise as is projected, the silver price will…(increase)

因此,如果投資需求(對價格的最大影響)繼續如預期般上升,白銀價格將……(上升)

One thing that could depress the silver price is if the vaccines work and are widely used, pushing the economy back to some sort of normal. While industrial demand won’t subside in that scenario, investment demand could, and thus push the price…(decrease)

可能壓低白銀價格的一件事是,疫苗能否奏效並得到廣泛使用,從而使經濟回到某種正常水平。儘管在這種情況下工業需求不會消退,但投資需求可能會因此而導致價格……(下降)

Silver would also likely decline if the stock market crashed or we entered a double dip recession.

如果股市崩盤或我們進入雙底衰退,白銀也可能下跌。

The Big (Silver) Picture

白銀宏觀展望

When looking at the price of silver over the next few years, probably the biggest catalyst is monetary dilution. When the currency is debased, it makes real assets like silver (and gold) more valuable, since they can’t be created with a few computer key strokes.

當看未來幾年的白銀價格時,最大的催化劑可能是貨幣稀釋化。當貨幣貶值時,它使諸如銀(和金)之類的真實資產變得更有價值,因為它們無法通過幾次計算機按鍵就能創建。

And now we have both monetary stimulus and fiscal stimulus. Monetary stimulus usually goes first to the banking system and ends up inflating asset prices. But fiscal stimulus are funds that will be injected directly into the economy and immediately spent. It’s like me giving you $100 and you deposit it in a savings account vs. spending it that day on groceries.

現在我們既有貨幣刺激措施,也有財政刺激措施。貨幣刺激通常首先進入銀行系統,最終導致資產價格膨脹。但是財政刺激措施是將直接注入經濟並立即支出的資金。就像我給您$ 100,然後將其存入儲蓄帳戶,而不是當天將其用於購買食品雜貨。

You probably don’t need me to say it, but the U.S. doesn’t have trillions of extra cash to spend on fiscal stimulus packages. It already can’t balance a budget. Some claim they’ll “collect” on the backend; as jobs are created and the economic grows, tax revenue will increase. But the debts and deficits are so high now they’re mathematically unpayable. And history shows these actions lead to inflation (higher consumer prices).

您可能不需要我這麼說,但是美國沒有數万億美元的額外現金可用於財政刺激計劃。它已經無法平衡預算。有些人聲稱他們將在後端“收集”;隨著創造就業機會和經濟增長,稅收將會增加。但是現在債務和赤字如此之高,以數學上來說是無法償還的。歷史表明,這些行為會導致通貨膨脹(較高的消費價格)。

Where will they get the funds for these stimulus programs? They have to create it (digital and otherwise), which will add to the already bloated deficit.

他們將從何處獲得這些刺激計劃的資金?他們必須創建它(數字或其他),這將增加已經膨脹的赤字。

It only takes a 6th grade education to understand that the more you create of something, the less valuable it becomes. As more and more currency units are created for these massive spending plans, the US dollar will become less and less valuable—and silver (and gold) more valuable.

只需接受六年級的教育,即可了解您創造的東西越多,其價值就越低。隨著為這些龐大的支出計劃創建越來越多的貨幣單位,美元的價值將越來越低,而白銀(和黃金)的價值將越來越高。

Now that the Democrats control all three branches of government, currency printing is sure to continue, and fiscal spending is certain to jump. Both of these things will have a direct impact on the silver price.

現在民主黨控制了政府的所有三個部門,貨幣印刷肯定會繼續,財政支出肯定會增加。這兩件事都會對白銀價格產生直接影響。

There is no vaccine for the coming monetary crisis. You might even say that they only silver (and gold) don’t rise is if they stop printing—but that won’t happen anytime soon. Austerity is completely off the radar in the world we live in right now. This is a built-in catalyst for higher silver prices.

沒有針對即將到來的貨幣危機的疫苗。您甚至可以說,如果停止打印,只有銀色(和金色)不會上升,但這不會很快發生。在我們現在生活的世界中,緊縮是完全不可行的。這是白銀價格上漲的內在催化劑。

Because of this, my most confident prediction is that over the next few years, possibly longer, the silver price is going to…(increase)

因此,我最自信的預測是,在未來幾年內,甚至更長的時間裡,白銀價格將會…(上漲)

My Silver Price Prediction

我的銀價預測

There are many other potential catalysts that could impact the silver price. Frankly, there are so many possibilities that they’re hard to catalog.

還有許多其他可能影響白銀價格的潛在催化劑。坦白說,有太多的可能性,很難分類。

What I covered here are the unique circumstances the silver market finds itself in right now, and why the upcoming bull market could be bigger than many anticipate.

我在這裡介紹的是白銀市場目前處於獨特的情況,以及為什麼即將到來的牛市可能比許多人預期的更大。

Suffice it to say that whatever impacts gold is also likely to impact silver.

只需說影響黃金的任何因素也可能影響白銀。

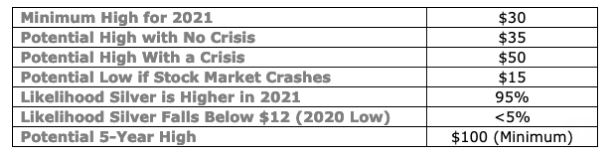

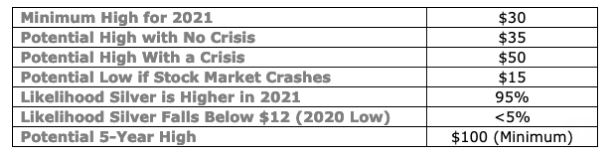

Based on all these factors, here are my predictions for the silver price for both 2021 and five years out.

基於所有這些因素,這是我對2021年和五年後白銀價格的預測。

Silver Price Predictions Chart

I encourage you to consider that regardless of where the price may end up over the next few years, silver represents a very compelling investment opportunity for the foreseeable future.

白銀價格預測圖

我鼓勵您考慮一下,不管在未來幾年中價格可能會上漲到哪裡,白銀在可預見的未來都是非常誘人的投資機會。

Regards,

Jeff Clark

HardAssetsAlliance

Shiny黃金白銀交易所

引用來源: HardAssetsAlliance.com

* 以上僅此作者個人觀點,不應做為投資建議。請務必詢問專業資產顧問再投資*

2021 白銀價格預測、走勢和5年預測

By Jeff Clark, Senior Analyst, HardAssetsAlliance.com

What will the silver price do in 2021? And where is it headed over the next 5 years?

2021年白銀價格將做什麼?未來5年的發展方向如何?

I’ve compiled silver price predictions from a number of precious metals analysts and consultancies. I also make my own prediction, based on the key factors that in my experience are most likely to influence the silver price both this year and the next five years.

我已經彙編了許多貴金屬分析師和諮詢公司的白銀價格預測。根據我的經驗,我也根據今年和未來五年最有可能影響白銀價格的關鍵因素做出自己的預測。

This will be fun, so let’s jump in!

這將會很有趣,我們開始吧!

Surveying the (Silver) Landscape

白銀市場調查報告

The table below shows the silver price prediction from various commodity and bank analysts for 2021. Here’s what they think we’ll see this year.

下表顯示了各種商品和銀行分析師對2021年白銀價格的預測。這就是他們認為我們今年會看到的價格。

Silver Price Predictions 2021

2021白銀價錢預測

Most industry analysts predict the silver price will move higher this year, though five project it will remain below $30.

大多數行業分析師預測,今年白銀價格將上漲,儘管有五個項目預測白銀價格將保持在30美元以下。

The average of all these analysts is in the low $32 range.

所有這些分析師的平均值都在32美元的低位範圍內。

But as you can see, that range is quite wide. And that is an important consideration when predicting where the price might go… silver can be very volatile at times, the result of its small market size and that it doesn’t take much cash entering or exiting to have a big impact on the price. As such, the swings—both up and down—can be bigger than what most other assets experience, including gold. This fact has to be taken into account when looking at how high or low the price might go.

但是正如您所看到的,該範圍非常廣泛。這是預測價格可能走向的一個重要考慮因素……白銀有時可能會非常波動,這是由於其市場規模小以及不需要花費大量現金進出對價格產生重大影響的結果。因此,波動(上下波動)可能大於包括黃金在內的大多數其他資產所經歷的波動。在查看價格可能高低時,必須考慮到這一事實。

What do I think the silver price will do this year, and over the next five years? To answer that question let’s look at the…

我認為今年和未來五年白銀價格將如何變化?為了回答這個問題,讓我們看一下...

Factors Most Likely to Influence Silver Prices

最有可能影響白銀價格的因素

While there are a number of variables that can impact the silver price, let’s look at those most likely to play out this year and beyond and determine if they’re likely to push the price higher or lower…

儘管有許多變量會影響白銀價格,但讓我們看一下今年和以後最有可能出現的那些變量,並確定它們是否有可能將價格推高或降低……

Industrial Demand

工業需求

Roughly half of all silver goes toward a variety of industrial applications (and another third to jewelry). Demand from industrial users usually doesn’t fluctuate all that much, but the next four years is likely to see a substantial increase due to President Biden’s“green” policies.

所有白銀中大約有一半用於各種工業應用(另一半用於珠寶業)。工業用戶的需求波動通常不會很大,但由於拜登總統的“綠色”政策,未來四年可能會出現大幅增長。

That’s because silver is a key component in many green technologies. Since it is most the most conductive of the metals, it is vital to making green technologies what they are. And given that a major focus for Biden is green energy, silver demand from the industrial sector is bound to grow.

那是因為銀是許多綠能技術的關鍵組成部分。由於它是金屬中最具導電性的,因此對製造綠能技術至關重要。鑑於拜登的主要重點是綠色能源,工業部門對白銀的需求必將增長。

If industrial demand grows as I expect, the silver price is likely to… (increase)

如果工業需求如我所願增長,白銀價格可能會…(上漲)

Investment Demand

投資需求

The factor that has the biggest impact on the silver price at any time is not industrial demand or jewelry demand. It is investment demand. Here’s the evidence…

任何時候對銀價影響最大的因素都不是工業需求或珠寶需求。是投資需求。這是證據……

This chart, going back to 1960, demonstrates the link between investment demand and prices. The red shaded areas show that selling from investors led to lower or weak price, while the green shaded areas show that rising demand from investors led to rising prices.

該圖表可以追溯到1960年,展示了投資需求和價格之間的聯繫。紅色陰影區域表示投資者的賣出導致價格下跌或走軟,而綠色陰影區域表示投資者的需求上升導致價格上漲。

Silver Price Investment Demand

The key to this chart is that when investment demand shifts from net selling to net buying, the price has risen (and vice versa). As such…

白銀價格投資需求

該圖表的關鍵在於,當投資需求從淨賣出轉向淨買入時,價格已經上漲(反之亦然)。因此…

• As investment demand goes, so goes the silver price.

投資需求增大,銀價也會隨之上漲

So are investors buying or selling silver?

所以投資客目前是買還是賣呢?

This chart from Nick Laird at GoldChartsRUs shows the total physical silver holdings by funds, exchanges, and storage facilities. Look what’s been happening…

GoldChartsRUs的尼克·萊爾德(Nick Laird)的這張圖表顯示了按資金,交易所和存儲設施的實際總白銀持有量。看看發生了什麼...

Total Silver Oz Held Worldwide

國際白銀現貨總額

Investment demand for physical metal has never been higher! Even when the vaccines came out investment demand continued to surge. Investors clearly want exposure to silver.

對實體金屬的投資需求從未如此高!即使疫苗問世,投資需求也繼續飆升。投資者顯然希望投資白銀。

The Silver Institute reported that they fully expect investment demand for bullion to continue to march higher in 2021.

Silver Institute報告稱,他們完全預計2021年對金條的投資需求將繼續增長。

I can also tell you that demand for silver bullion spiked at Hard Assets Alliance last year, particularly when scares about the virus exploded, along with the stock market crash in March. Volumes went through the roof. They’ve spiked again in January.

我還可以告訴你,去年硬資產聯盟對白銀的需求激增,特別是當對這種病毒的擔憂激增以及3月份股市崩盤時。大量的東西穿過屋頂。他們在一月份再次飆升。

As such, if investment demand—the biggest impact on the price— continues to rise as is projected, the silver price will…(increase)

因此,如果投資需求(對價格的最大影響)繼續如預期般上升,白銀價格將……(上升)

One thing that could depress the silver price is if the vaccines work and are widely used, pushing the economy back to some sort of normal. While industrial demand won’t subside in that scenario, investment demand could, and thus push the price…(decrease)

可能壓低白銀價格的一件事是,疫苗能否奏效並得到廣泛使用,從而使經濟回到某種正常水平。儘管在這種情況下工業需求不會消退,但投資需求可能會因此而導致價格……(下降)

Silver would also likely decline if the stock market crashed or we entered a double dip recession.

如果股市崩盤或我們進入雙底衰退,白銀也可能下跌。

The Big (Silver) Picture

白銀宏觀展望

When looking at the price of silver over the next few years, probably the biggest catalyst is monetary dilution. When the currency is debased, it makes real assets like silver (and gold) more valuable, since they can’t be created with a few computer key strokes.

當看未來幾年的白銀價格時,最大的催化劑可能是貨幣稀釋化。當貨幣貶值時,它使諸如銀(和金)之類的真實資產變得更有價值,因為它們無法通過幾次計算機按鍵就能創建。

And now we have both monetary stimulus and fiscal stimulus. Monetary stimulus usually goes first to the banking system and ends up inflating asset prices. But fiscal stimulus are funds that will be injected directly into the economy and immediately spent. It’s like me giving you $100 and you deposit it in a savings account vs. spending it that day on groceries.

現在我們既有貨幣刺激措施,也有財政刺激措施。貨幣刺激通常首先進入銀行系統,最終導致資產價格膨脹。但是財政刺激措施是將直接注入經濟並立即支出的資金。就像我給您$ 100,然後將其存入儲蓄帳戶,而不是當天將其用於購買食品雜貨。

You probably don’t need me to say it, but the U.S. doesn’t have trillions of extra cash to spend on fiscal stimulus packages. It already can’t balance a budget. Some claim they’ll “collect” on the backend; as jobs are created and the economic grows, tax revenue will increase. But the debts and deficits are so high now they’re mathematically unpayable. And history shows these actions lead to inflation (higher consumer prices).

您可能不需要我這麼說,但是美國沒有數万億美元的額外現金可用於財政刺激計劃。它已經無法平衡預算。有些人聲稱他們將在後端“收集”;隨著創造就業機會和經濟增長,稅收將會增加。但是現在債務和赤字如此之高,以數學上來說是無法償還的。歷史表明,這些行為會導致通貨膨脹(較高的消費價格)。

Where will they get the funds for these stimulus programs? They have to create it (digital and otherwise), which will add to the already bloated deficit.

他們將從何處獲得這些刺激計劃的資金?他們必須創建它(數字或其他),這將增加已經膨脹的赤字。

It only takes a 6th grade education to understand that the more you create of something, the less valuable it becomes. As more and more currency units are created for these massive spending plans, the US dollar will become less and less valuable—and silver (and gold) more valuable.

只需接受六年級的教育,即可了解您創造的東西越多,其價值就越低。隨著為這些龐大的支出計劃創建越來越多的貨幣單位,美元的價值將越來越低,而白銀(和黃金)的價值將越來越高。

Now that the Democrats control all three branches of government, currency printing is sure to continue, and fiscal spending is certain to jump. Both of these things will have a direct impact on the silver price.

現在民主黨控制了政府的所有三個部門,貨幣印刷肯定會繼續,財政支出肯定會增加。這兩件事都會對白銀價格產生直接影響。

There is no vaccine for the coming monetary crisis. You might even say that they only silver (and gold) don’t rise is if they stop printing—but that won’t happen anytime soon. Austerity is completely off the radar in the world we live in right now. This is a built-in catalyst for higher silver prices.

沒有針對即將到來的貨幣危機的疫苗。您甚至可以說,如果停止打印,只有銀色(和金色)不會上升,但這不會很快發生。在我們現在生活的世界中,緊縮是完全不可行的。這是白銀價格上漲的內在催化劑。

Because of this, my most confident prediction is that over the next few years, possibly longer, the silver price is going to…(increase)

因此,我最自信的預測是,在未來幾年內,甚至更長的時間裡,白銀價格將會…(上漲)

My Silver Price Prediction

我的銀價預測

There are many other potential catalysts that could impact the silver price. Frankly, there are so many possibilities that they’re hard to catalog.

還有許多其他可能影響白銀價格的潛在催化劑。坦白說,有太多的可能性,很難分類。

What I covered here are the unique circumstances the silver market finds itself in right now, and why the upcoming bull market could be bigger than many anticipate.

我在這裡介紹的是白銀市場目前處於獨特的情況,以及為什麼即將到來的牛市可能比許多人預期的更大。

Suffice it to say that whatever impacts gold is also likely to impact silver.

只需說影響黃金的任何因素也可能影響白銀。

Based on all these factors, here are my predictions for the silver price for both 2021 and five years out.

基於所有這些因素,這是我對2021年和五年後白銀價格的預測。

Silver Price Predictions Chart

I encourage you to consider that regardless of where the price may end up over the next few years, silver represents a very compelling investment opportunity for the foreseeable future.

白銀價格預測圖

我鼓勵您考慮一下,不管在未來幾年中價格可能會上漲到哪裡,白銀在可預見的未來都是非常誘人的投資機會。

Regards,

Jeff Clark

HardAssetsAlliance

Shiny黃金白銀交易所

引用來源: HardAssetsAlliance.com

* 以上僅此作者個人觀點,不應做為投資建議。請務必詢問專業資產顧問再投資*